Identity theft cases spike in Los Angeles

Eddie Kim was looking at his online bank statement last December when he came across something suspicious. There was a $500 cash advance from his new credit card. The problem was, Kim had flown out of the country shortly after applying for the card, and had not received it yet.

“I thought, ‘Wait, that doesn’t make sense,’” said Kim. “I called the bank and found out someone tried to withdraw money using a cash advance, then somehow got approved.”

When Kim returned to his Torrance home, he found out that his mailbox had been broken into. He reported the identity theft to his credit card issuer, got a post office box, and changed his information. But the thieves had created a fake email, and a nightmare of identity theft was underway.

Although Kim took steps to protect himself, such as freezing his credit file, the thieves sought to counter every move, and tried to open a Walmart credit card. Months later, he still feels vulnerable.

“I’m pretty sure my information is still out there somewhere,” he said.

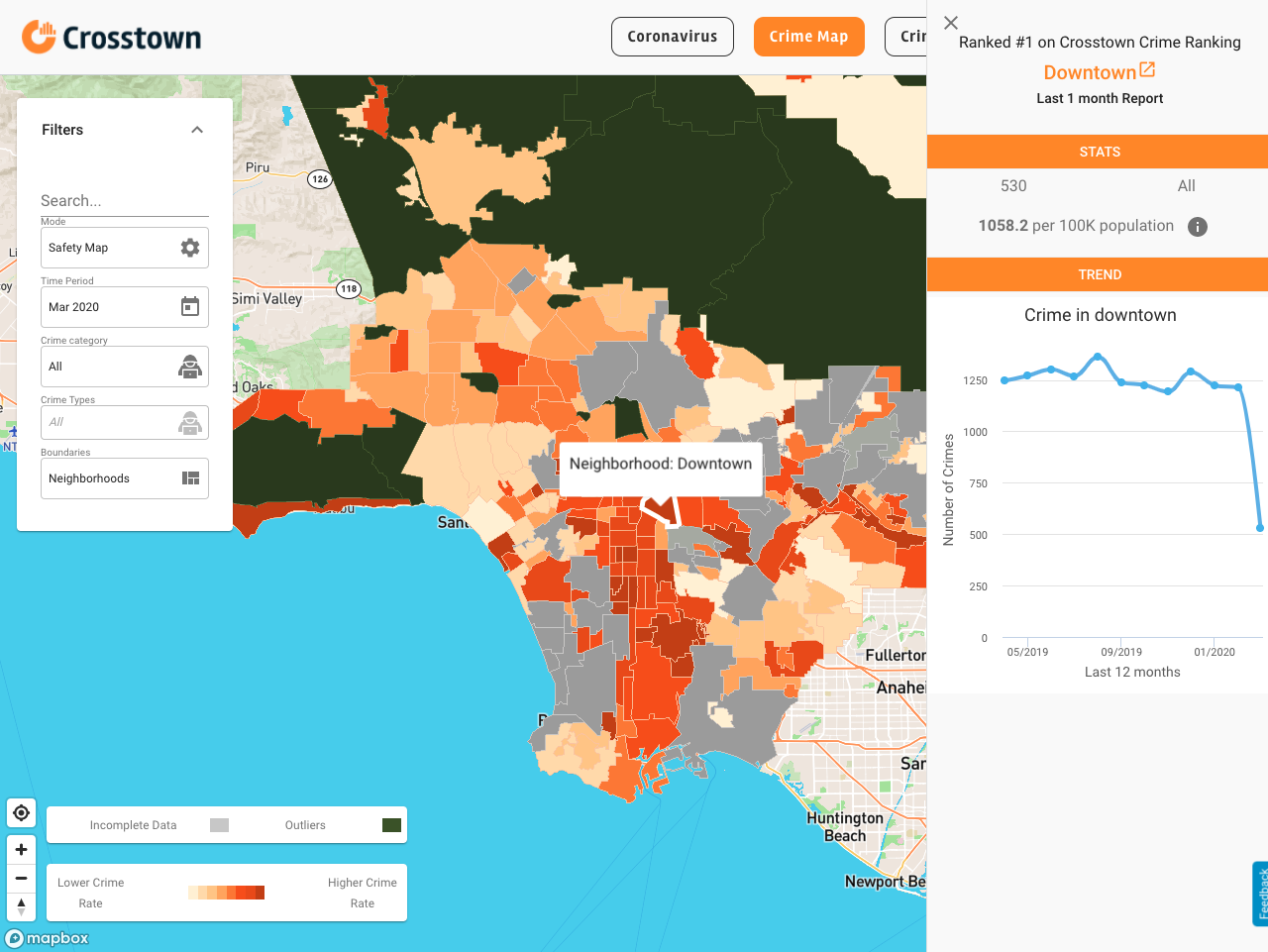

[Get COVID-19, crime and other stats about where you live with the Crosstown Neighborhood Newsletter]

Kim’s situation is not unique. Unfortunately for him and many others, cases have been surging in Los Angeles. In February, there were 1,272 reports of identity theft in the city, according to publicly available Los Angeles Police Department data. That was a 104% increase over the number of crimes in the same month last year.

March was worse: The 1,437 reports of identity theft was the highest monthly total since January 2016.

According to Lt. Manny Martinez of the LAPD Commercial Crimes Division, the recent rash of local identity thefts stems from thieves trying to steal information so they can apply for unemployment benefits or EBT cards. The cards allow recipients of government assistance to pay retailers for their purchases.

Martinez said thieves are trying to take advantage of a lag in the time it takes for victims to notice someone has stolen their identity.

“That’s probably because the California government is requiring people to file a police report before they can determine it isn’t you and cancel the account,” he said.

For a long time, Martinez added, employees of the California Employment Development Department did not do thorough checks on credentials, because the aim was to quickly get money to people who needed it. Criminals took advantage of that situation, he said.

“The state is getting better on the checking, but for a long time the process was streamlined,” Martinez said.

Pandemic spike

Unemployment insurance fraud ballooned early in the pandemic. The state has paid out at least $20 billion in fraudulent benefits since the onset of COVID-19.

The problem has not gone away. In January, CalMatters reported that the EDD has been beset with fraud cases.

That has been manifested in Los Angeles, said Capt. Alfonso Lopez of the LAPD Commercial Crimes Division.

“Identity theft is related to people going back to work, people going to dinner, burglary from vehicles and skimming a card,” Lopez said. “But this most recent increase, based on our analysis, is due to EBT and EDD theft.”

Thieves employ a variety of methods to steal an identity. Some put skimmers and scanners on gas pumps. Others break into vehicles or homes to take credit cards and other forms of identification.

Then there is mail theft, which can come in different forms. Sometimes thieves break open mailboxes. Other times they try to fish out individual pieces of mail, hoping to find personal or financial information, Martinez said.

“Some mail might have a birthdate, and some other mail might have a social [security number],” he said. “They just put that all together, and now they have your profile.”

In the first quarter of 2022, single-family homes were the site of 43% of identity thefts in the city, according to LAPD data.

Another contributing factor, said Martinez, is that most businesses have reopened, and others are increasingly loosening restrictions put in place during the pandemic. This presents the opportunity for additional victims.

“More people are shopping, they’re going to restaurants, they’re using their cards,” he said. “People are obtaining people’s information because it’s more readily accessible.”

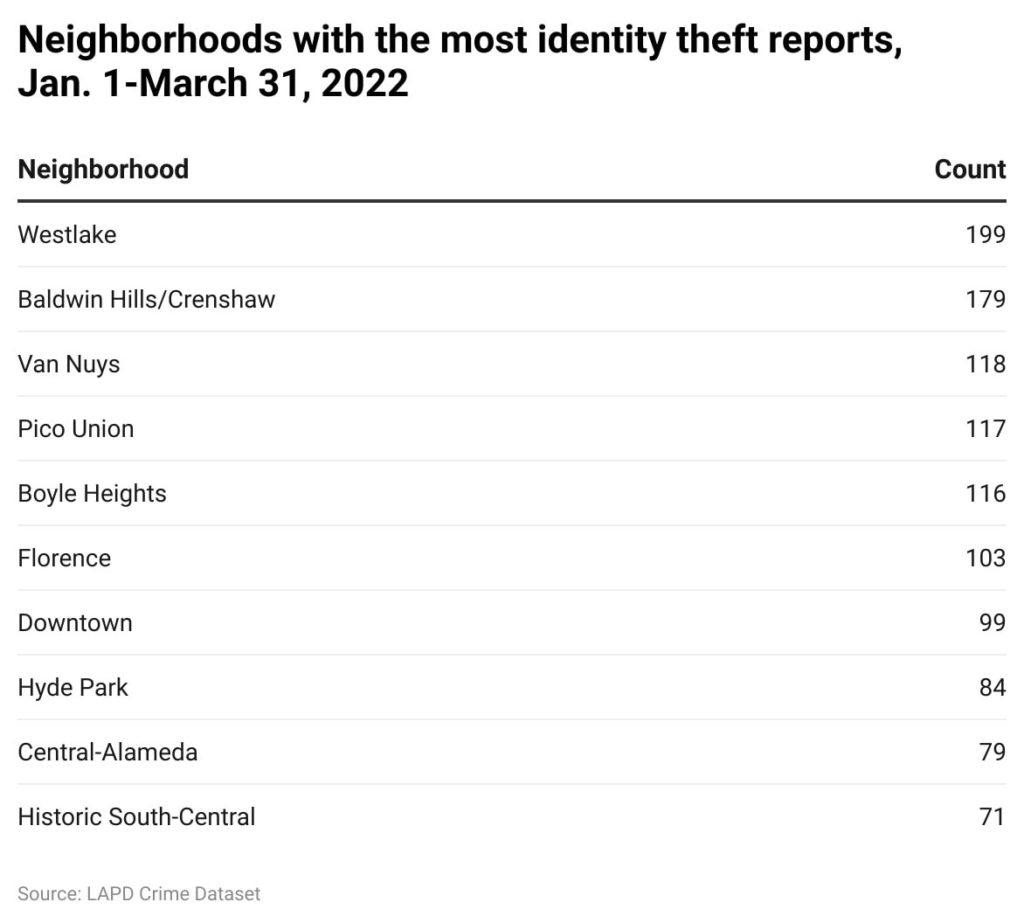

In the first quarter of 2022, Westlake logged 199 reports of identity theft, more than any other Los Angeles neighborhood. Criminals were also highly active in Baldwin Hills/Crenshaw (179 incidents).

The LAPD has a number of suggestions to avoid becoming a victim of identity theft, including always taking credit card receipts and never throwing them away in a public trash container.

Martinez suggests getting a PO box and, when using an ATM, covering up the keypad while punching in the PIN code.

How we did it: We examined publicly available identity theft data from the Los Angeles Police Department from Jan. 1, 2016-March 31, 2022. For neighborhood boundaries, we rely on the borders defined by the Los Angeles Times. Learn more about our data here.

LAPD data only reflects crimes that are reported to the department, not how many crimes actually occurred. In making our calculations, we rely on the data the LAPD makes publicly available. LAPD may update past crime reports with new information, or recategorize past reports. Those revised reports do not always automatically become part of the public database.

Have questions about our data? Write to us at askus@xtown.la.