‘Mansion Tax’ illustrates depth of L.A.’s economic divide

(Image generated with Midjourney)

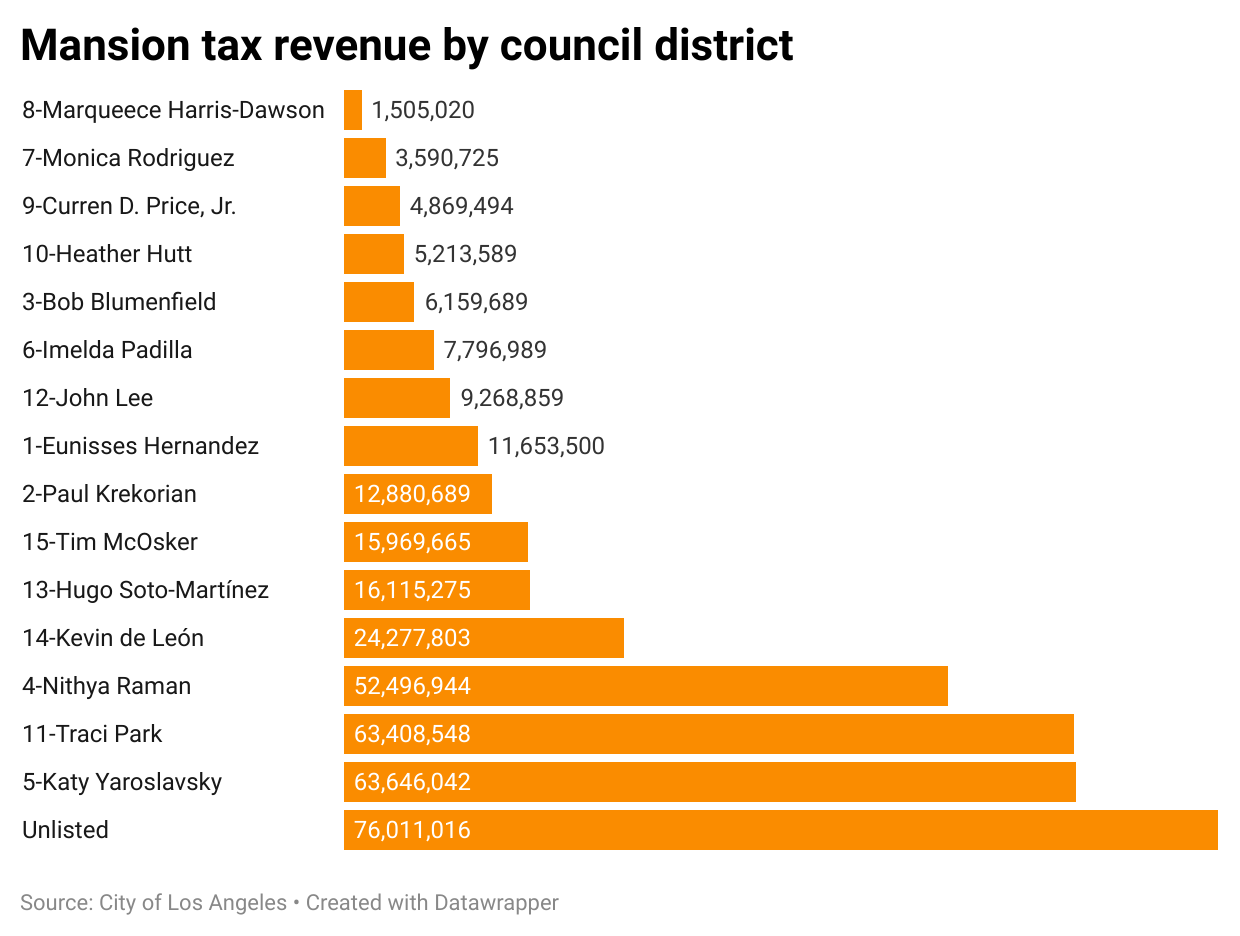

Since Measure ULA, also known as the “Mansion Tax,” went into effect in April 2023, there have been some eye-popping numbers: The sale of a single Downtown office building generated $10.2 million in tax revenue to be used for affordable housing and other homelessness services in the city of Los Angeles. The sale of one home on the Westside put $3.6 million in the coffers.

That kind of windfall was what proponents of the measure envisioned when it was placed on the November 2022 ballot. But digging deeper into the publicly available data shows some other things: how deep the geographical and economic divide is in the city; and how far under estimates the revenues to date are.

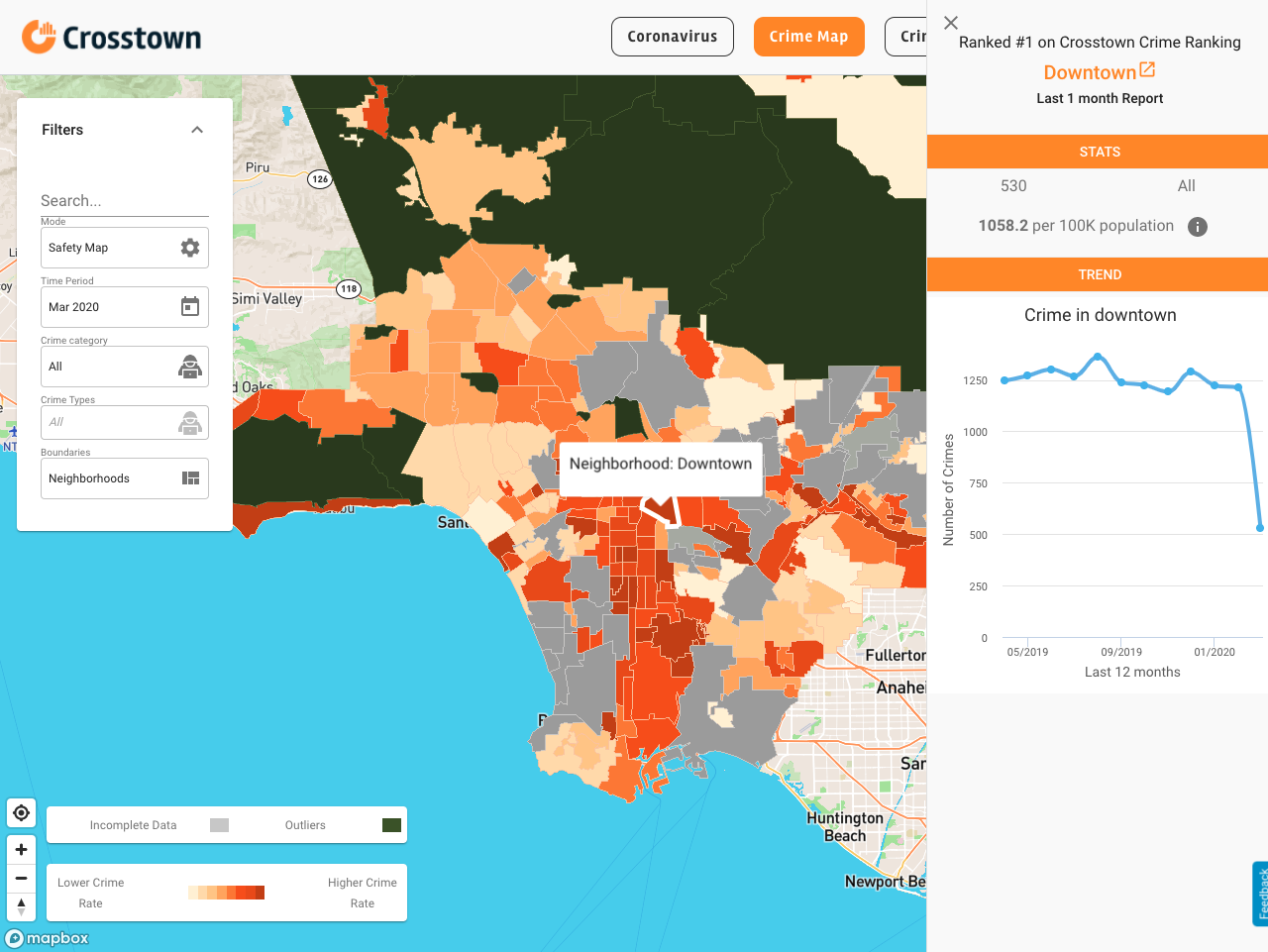

According to a ULA dashboard from the Los Angeles Housing Department, from May 2023 to August 2024, the city raised $375 million in taxes on the sale of 593 properties priced at more than $5 million. While the results will help efforts to address the homelessness crisis, critics point out the measure was expected to produce at least $600 million a year, and as much as $1.1 billion (according to the official ballot summary).

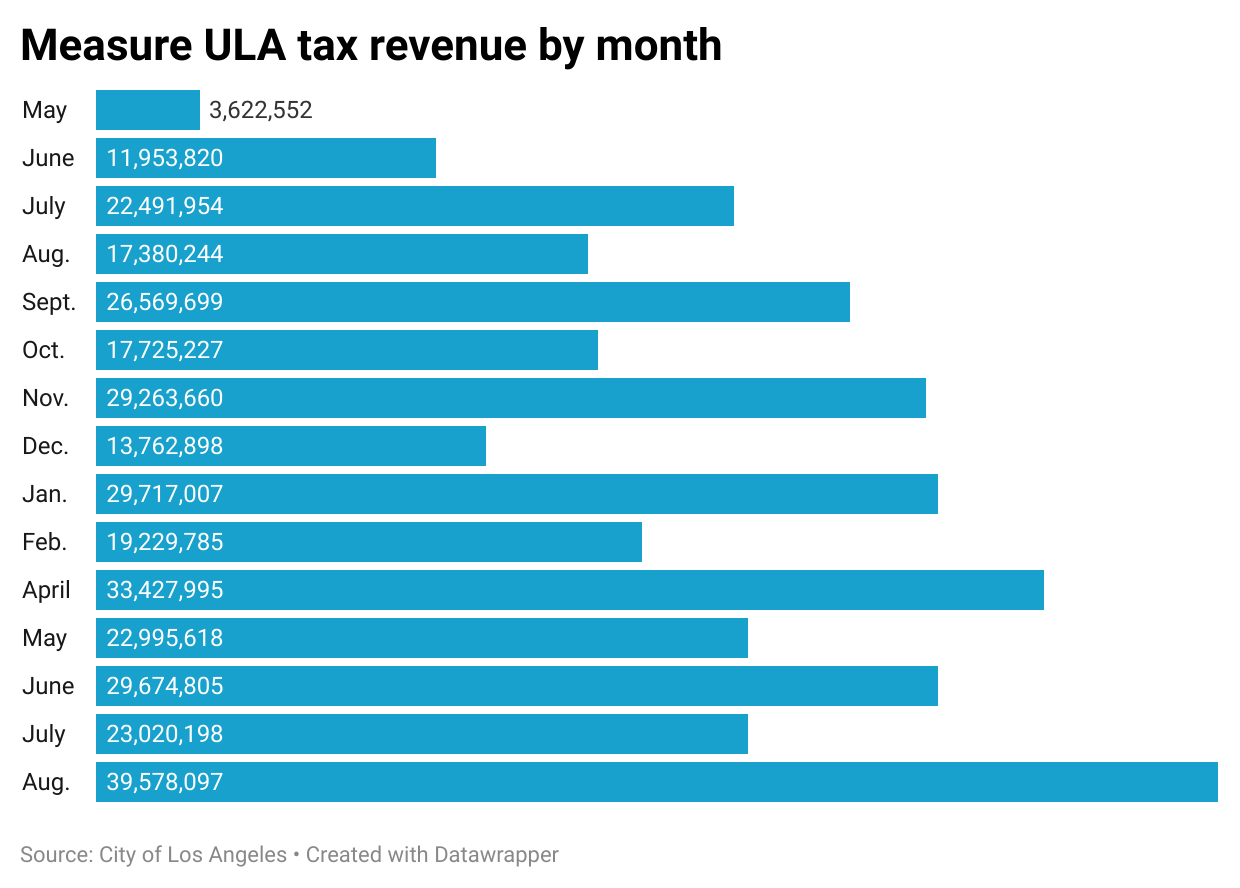

Then there is location: Of those 593 sales, more than half occurred in just three of the city’s 15 council districts, led by the 149 transactions in the Westside’s District 11, which stretches along a large swath of the Pacific Ocean.

Meanwhile, just three sales north of $5 million were recorded in District 8, which includes South L.A. In fact, the eight lowest-producing districts together recorded just 57 sales.

Addressing homelessness

The tax imposed a 4% levy on residential and commercial properties sold in the city for more than $5 million, and a 5.5% assessment on properties over $10 million (the threshold increased to $5.15 million and $10.3 million, respectively, on July 1). It was approved by 58% of voters in November 2022.

According to an April report from researchers at Occidental College, University of California, Los Angeles, and the University of Southern California, Measure ULA is the largest source of revenue in the city budget for tackling homelessness and creating affordable housing. During the measure’s first year, the report finds, an estimated 11,000 Angelenos received emergency rental assistance, while thousands of tenants received legal aid.

Indeed, in August, Mayor Karen Bass and the City Council approved spending $150 million in ULA funds for their anti-homelessness efforts.

Detractors from the outset warned that the measure would actually lead to higher costs for renters in the region and stagnate the housing market for higher-end properties. Long-time developers are familiar with navigating the city’s bureaucratic thicket. Shane Phillips, housing initiative manager at the UCLA Lewis Center for Regional Policy Studies, which in August released its own report on ULA, said that the measure does not exempt first-time developers. That might end up scaring off newcomers, many of whom are working on projects that are specifically designated as affordable housing.

Market conditions

ULA revenues are certainly below initial projections, but that may also have to do with general market conditions. Eden Burkow, a real estate agent with Sotheby’s International Realty, pointed out interest rates, which had been close to zero during the pandemic, quickly shot up to more than 5%. Higher rates can mean millions more in financing costs for developers who borrow to build large projects.

Then there was the rush as people tried to sell high-value properties right before the new tax went into effect in April 2023. In a several-month period, luxury property sales doubled from just over 6% of all real estate transactions to 12%. In the subsequent quarter, luxury properties accounted for around 2% of property transactions.

Burkow said that in early 2023, the general consensus was, “If they were going to sell or buy something, the time would be now, before they would have a more intense tax. Some people were definitely in a rush.”

Burkow believes buyers are now coming to terms with the tax.

“It’s simply an adjustment period,” she said. “It’s an adjustment for the buyer that needs to now pay this premium. It’s an adjustment for a seller. It’s an adjustment for the mortgage brokers. It’s an adjustment for the real estate agents. It’s an adjustment for everyone.”

That is being borne out in recent numbers. June and August produced the highest number of monthly sales since Measure ULA took effect, with 58 and 70 transactions, respectively.

The city also received more revenue during this period, as April, May and August were the highest monthly totals yet, raking in over $100 million combined.

Where the mansions are

Another takeaway is that, despite the nickname, the “Mansion Tax” is about more than palatial estates. Of the 593 sales, 333, or approximately 56%, were of single-family homes. There were 122 sales, or 20%, of commercial buildings. The remainder involved multi-family buildings, vacant lots or something else.

This, too, is reflected in the city’s geographic divide. Of the 149 sales in Council District 11, which includes the communities of Venice, Pacific Palisades and Brentwood, 90% were single-family homes.

In District 5, which includes tony Cheviot Hills, Bel Air and Beverly Glen, 93% of the sales were single-family homes.

Meanwhile, District 14, which includes Downtown, had 19 transactions, with 16 of them listed as commercial properties.

How we did it: We analyzed publicly available data from the city of Los Angeles on revenue and sales from Measure ULA. Have questions about our data? Write to us as askus@xtown.la.