Building slowdown could further tighten housing market

(Created with Mid-Journey)

(Created with Mid-Journey)

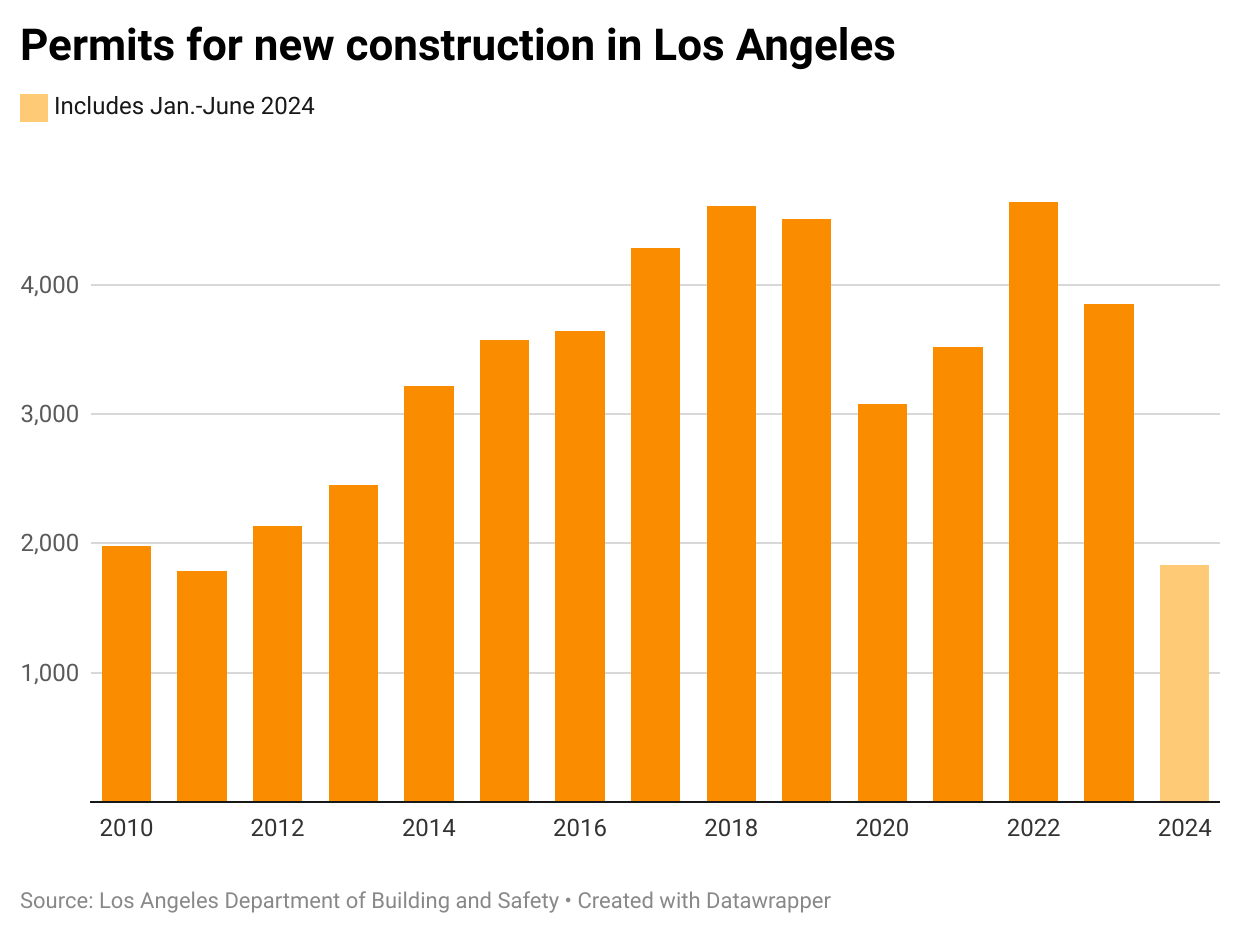

The pace of new construction in Los Angeles is slowing, raising the specter of rising rents and a diminished ability to address the region’s chronic housing shortage.

New building permits in the city of Los Angeles for the first half of 2024 totaled 1,831, a 10% drop from the same period a year earlier and down 60% from five years ago. Other indicators are also pointing toward a slowdown in construction.

Few issues can shape the future of Los Angeles as much as housing supply, which impacts everything from population growth to homelessness. Over the past year, the city had begun to eke out some modest progress. Last year, rents in Los Angeles actually shrank slightly, the result of many new housing units hitting the market. The city’s unsheltered population also fell for the first time in six years. But any slackening in the pace of construction threatens to reverse those gains.

“The supply-demand balance is almost certainly going to shift, and the market is going to tighten,” said Rob Warnock, a senior research associate with the real estate rental platform Apartment List.

Permits issued for new construction are one of the most surefire indicators of future housing, as they act as sort of a starting pistol for building. However, it can take years for a project to move from the permit to finished units.

The city’s housing element, a projection of how many units it must create in order to satisfy demand, is 456,643 between 2021 and the end of the decade. Roughly a third of those are supposed to be designated as affordable or available to people with low incomes. In the effort to hasten this, one of Mayor Karen Bass’s first moves was issuing an executive directive to fast-track shelters and affordable housing projects. Her office has stated that approvals that once took six months can now be granted in about 45 days.

Still, there is no clear accounting of how many units have been produced since 2021. But it appears exceedingly unlikely that the city will come close to meeting the goal at its current pace.

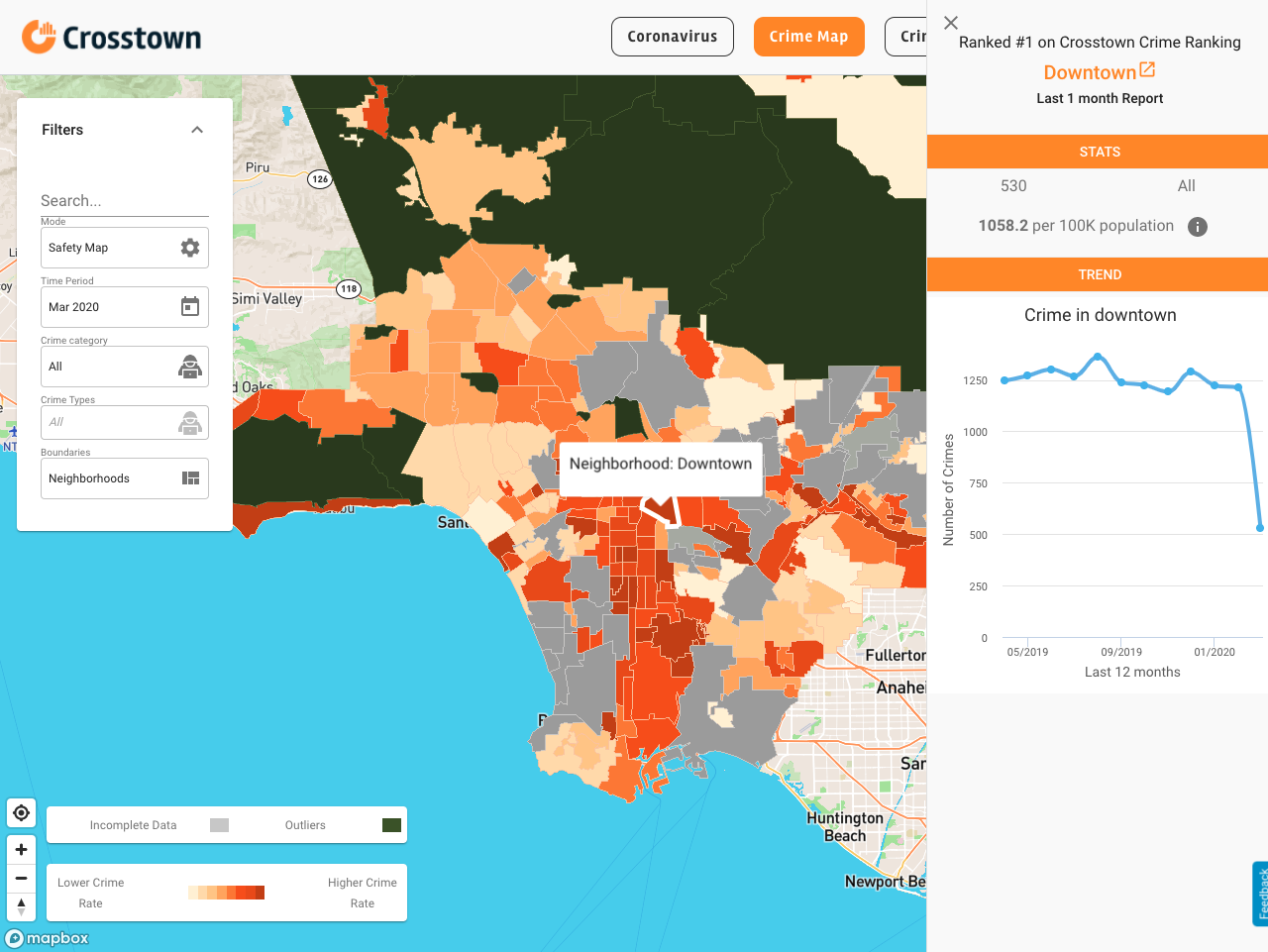

[Get crime, housing and other stats about where you live with the Crosstown Neighborhood Newsletter]

The last few years have been bumpy for building in Los Angeles. It took time to shake off the hangover from the 2008-09 financial crisis. But after that, the greater Los Angeles area embarked on a construction boom, breaking ground on new office towers, luxury apartment blocks and single-family homes.

That came to a screeching halt during the COVID era, but picked up just as the pandemic began to wane. Still, that second wind turned out to be short-lived, as a variety of factors, including high interest rates and rising costs, began to hit the sector.

“The year 2022 was the peak for many places,” said Warnock. But all the factors that led to that have now inverted. “Debt was cheap, rents were skyrocketing. From a financial perspective, building a multi-unit project was sort of a cash cow. None of those things are still true,” he said.

“A lot of the financing that was locked in several years ago is coming to fruition today,” Warnock continued. “We can see that permits are tanking today as completions are peaking.”

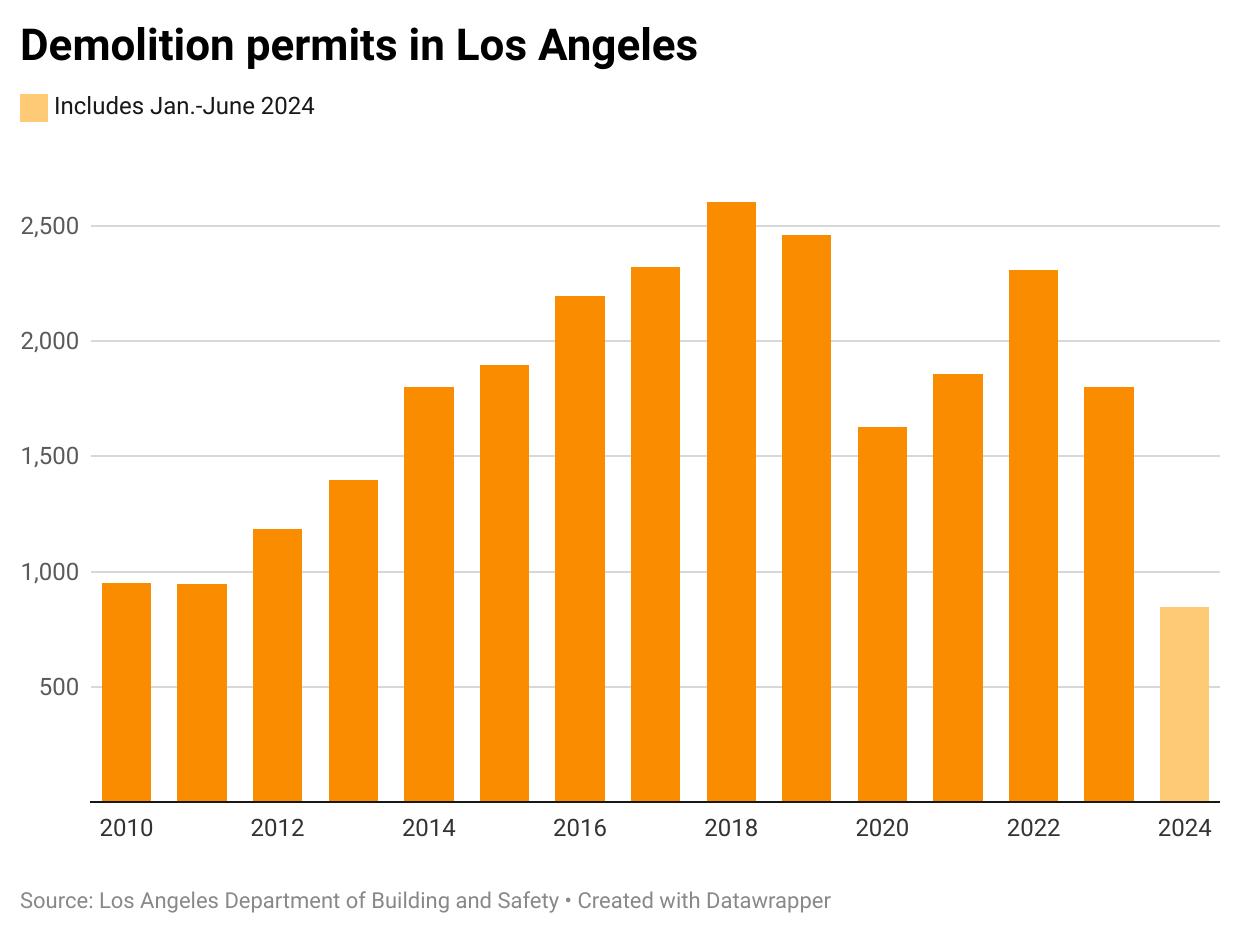

Demolition drop

In dense areas such as Los Angeles, permits for new construction are often preceded by demolition permits that clear a building site. Those have also been falling. In the third quarter of 2019, just before the pandemic, the city issued 672 demolition permits. In the most recent quarter, ending June 30, the number was 451.

Kevin Nielsen runs Nielsen Environmental, which specializes in demolitions and other projects, such as asbestos abatement. The problem isn’t just high interest rates, which have made financing for building projects more costly, he noted. It’s also the rising prices for labor and materials. Some jobs just no longer pencil out.

“Labor is so expensive it makes it really hard. By the time you go out there and make your bid, you realize you’re not making any money, so why bother,” he said.

The fall in permits in Los Angeles is outpacing that in most other major metropolitan areas in the U.S. On a per-capita basis, Los Angeles now ranks 32nd for new permits among large metro regions. In 2015, the city came in at No. 15, according to Apartment List data.

But Los Angeles is not alone. San Francisco is also experiencing a decline in permits. This comes despite a bevy of new laws in California designed to ease the permitting and planning process for new housing.

How we did it: We examined building permit data from the Los Angeles Department of Building and Safety for the past 14 years. We also analyzed data provided by Apartment List and other sources.

Have questions about our data? Write to us at askus@xtown.la