The pandemic pushed LA rents even higher

In May 2020, two months into the lockdown, unemployment in Los Angeles County shot up to 18.8%, as businesses sent workers home in droves. That wave of financial pain should have forced rent prices down, right?

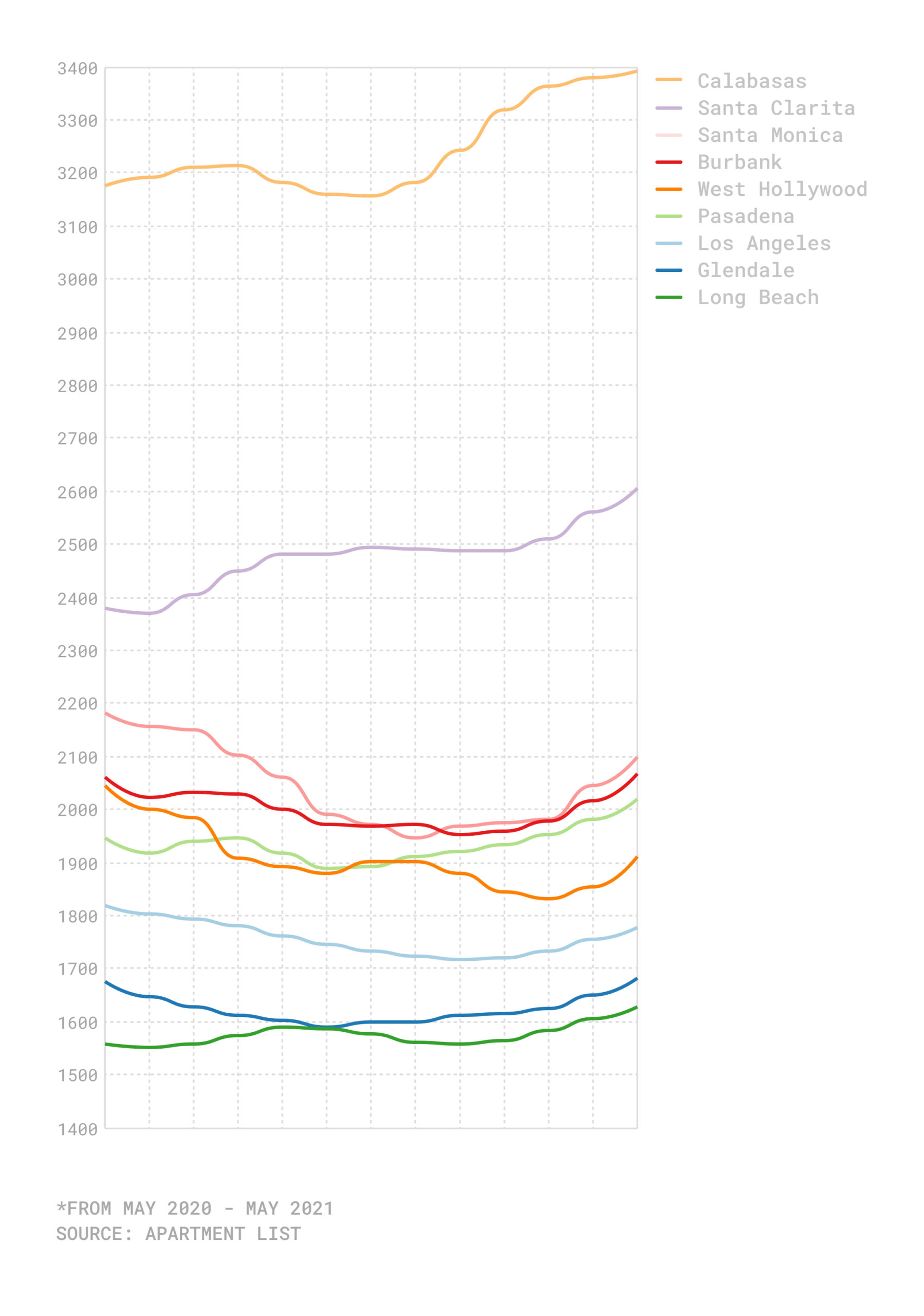

Not exactly. In examining rents in nine cities across Los Angeles County between May 2020 and May 2021, rents fell only in three, while rising in six of them, according to data compiled by Apartment List, a real-estate listing service.

The increases indicate just how little the region’s notoriously tight housing market will budge even when battered by powerful economic forces. Though all nine cities registered temporary reductions in rent sometime during the 12-month period, they were often short-lived.

Average rent by city, May 2020-May 2021

Rent fluctuations followed a pattern: Denser, urban areas saw declines, while farther flung suburbs recorded increases. That appears to match a nationwide trend during the pandemic, as people who no longer needed to physically commute to work fled to places that offered more space and greenery.

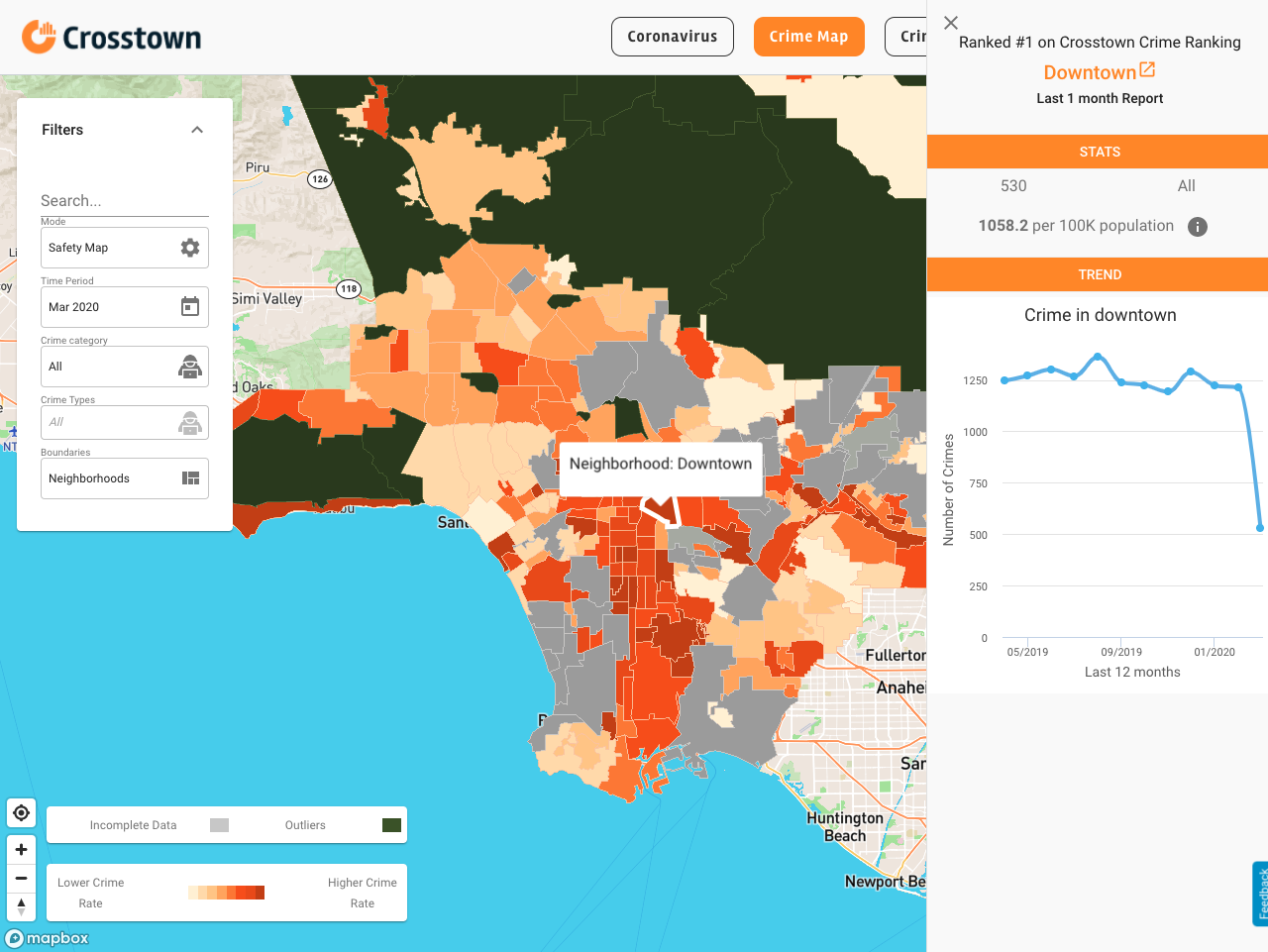

[Get COVID-19, crime and other stats about where you live with the Crosstown Neighborhood Newsletter]

The three cities with declines in rent were Los Angeles, West Hollywood and Santa Monica. Meanwhile, more far-flung places such as Calabasas and Santa Clarita had the steepest hikes.

Percent change of average rent by city, May 2020-May 2021

“The areas of the metro that are more affordable and more suburban, you can get more space for your money, less density— they have fared better than the locations that are more urban like Downtown L.A., Koreatown and the Westside,” said Ryan Patap, a real-estate analyst with the firm CoStar.

Dwindling allure of Downtown

While Los Angeles shut down amenities, restaurants and nightlife at the peak of the pandemic, the value of residing in those of these areas diminished. Now, with remote work becoming a norm for many Los Angeles residents, the appeal of office proximity to the city declined.

“They’re only coming in [to work] a couple times a week,” Patap said. “The value, especially during the pandemic, of being close to jobs diminished somewhat.”

West Hollywood had the biggest drop, with the average rent falling 6.56% to an overall average $1910. Calabasas retained its title as the most expensive city in Los Angeles County for renters. Long Beach, followed by Glendale, were the cheapest, according to the Apartment List data.

Housing shortage

Los Angeles suffers from a chronic housing shortage, a legacy of years of sluggish building dating back to the 1980s. Lately, that has contributed to slowing population growth and spiking homelessness. The pandemic only accelerated the affordability crisis, with the median home sale price hitting an all-time high of $667,000 in May.

Worried that the pandemic would displace many renters, the state extended an eviction moratorium through Sept. 30. Tenants must pay at least 25% of their rent and must show proof of low income. However, the $5.2 billion in state funding covering back and forward rent for landlords hasn’t stopped some from trying to push residents out.

Francisco George, who lives in the Mid-Wilshire neighborhood, said his landlord offered him a lump-sum of $21,000 to vacate his rent-controlled unit to make way for higher paying tenants.

“I am paying more than I can afford,” George said. “And I struggle to make that payment.” If he took the landlord’s payment, he’d have to find a more expensive place, which would eat up the difference in a matter of months, he said.

He complained that renters have little leverage in this situation. “They don’t see [us] as people. They see us as an inconvenience. And obstacle to their investment.”

Even with the dip in rent for the city, Los Angeles’s housing crisis still persists. According to an L.A. County Housing Needs Report published in May, renters need to earn 2.5 times the minimum wage to afford the average asking rent in Los Angeles County.

According to 2019 U.S. Census numbers, Los Angeles has some of the highest rental rates in the country, with 63.2% of residents living in units they don’t own compared with the nationwide average of 46%. This is driven in part by a red-hot property market which has pushed homeownership beyond the reach of many. Looking at specific neighborhoods, many near full-renter status, such as Downtown with 93.4%, Westlake at 94.9% and Koreatown at 93%.

How we did it: We compiled monthly average rent data provided by Apartment List from across Los Angeles County for the period from May 2020-May 2021.