Is a new building boom taking off in Los Angeles?

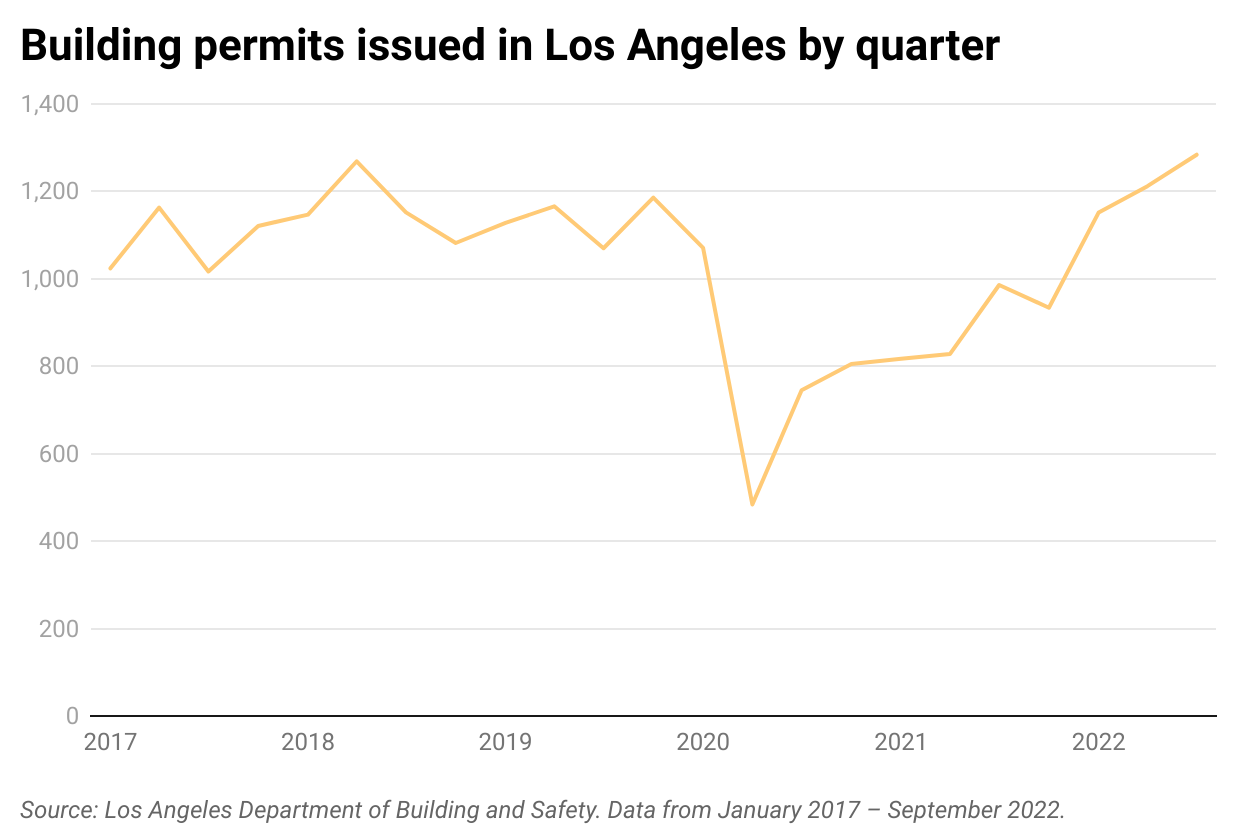

In August, the city of Los Angeles issued 17,008 building permits, the highest monthly total in three years. That was followed by another strong month in September, with 15,146.

The elevated number of permits issued by the city’s Department of Building and Safety is a sign of a strong construction sector, an important source of employment in the region. It can also signal an uptick in the construction of single-family homes and apartments, which are sorely needed to address the region’s chronic housing shortage.

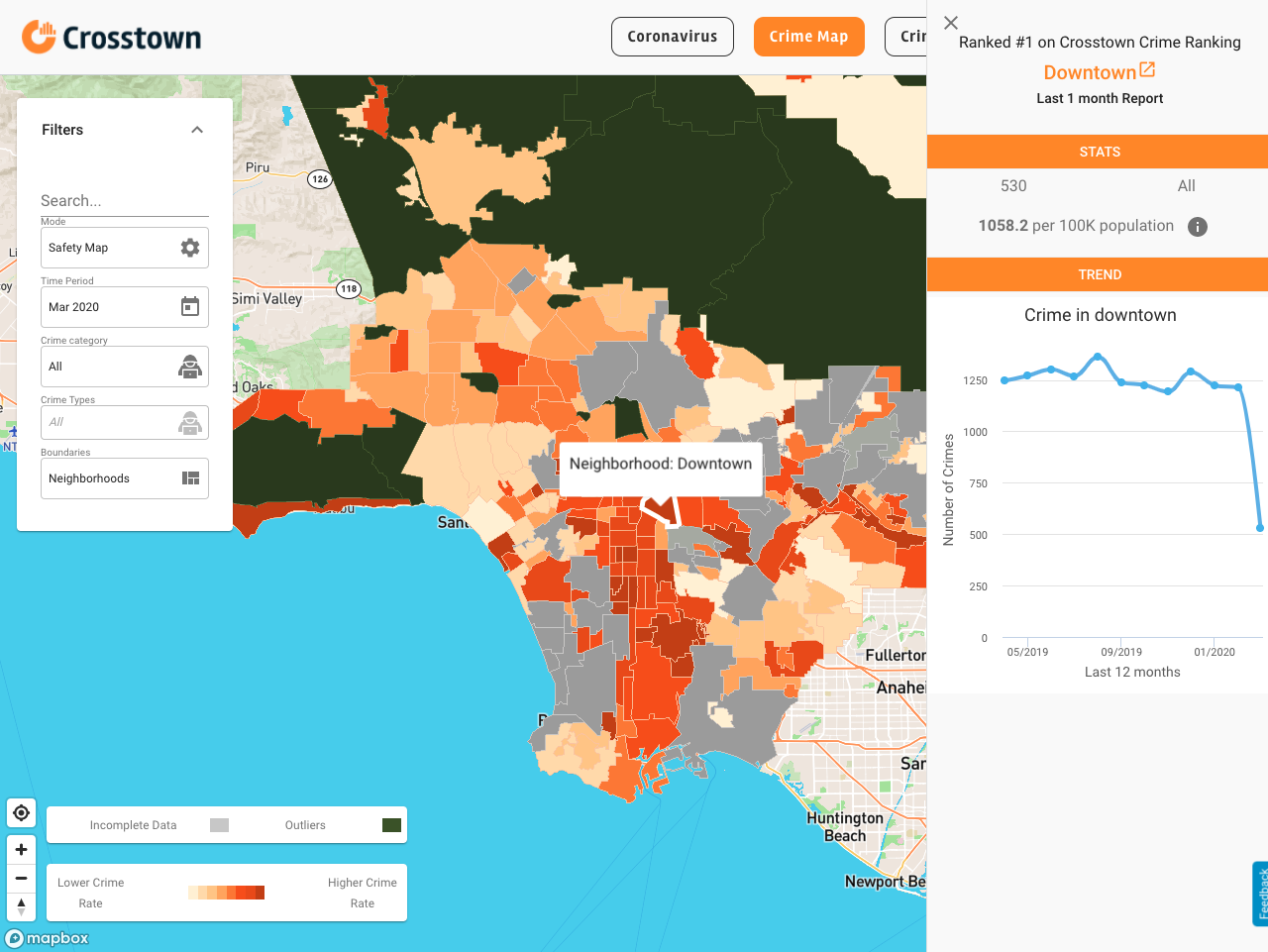

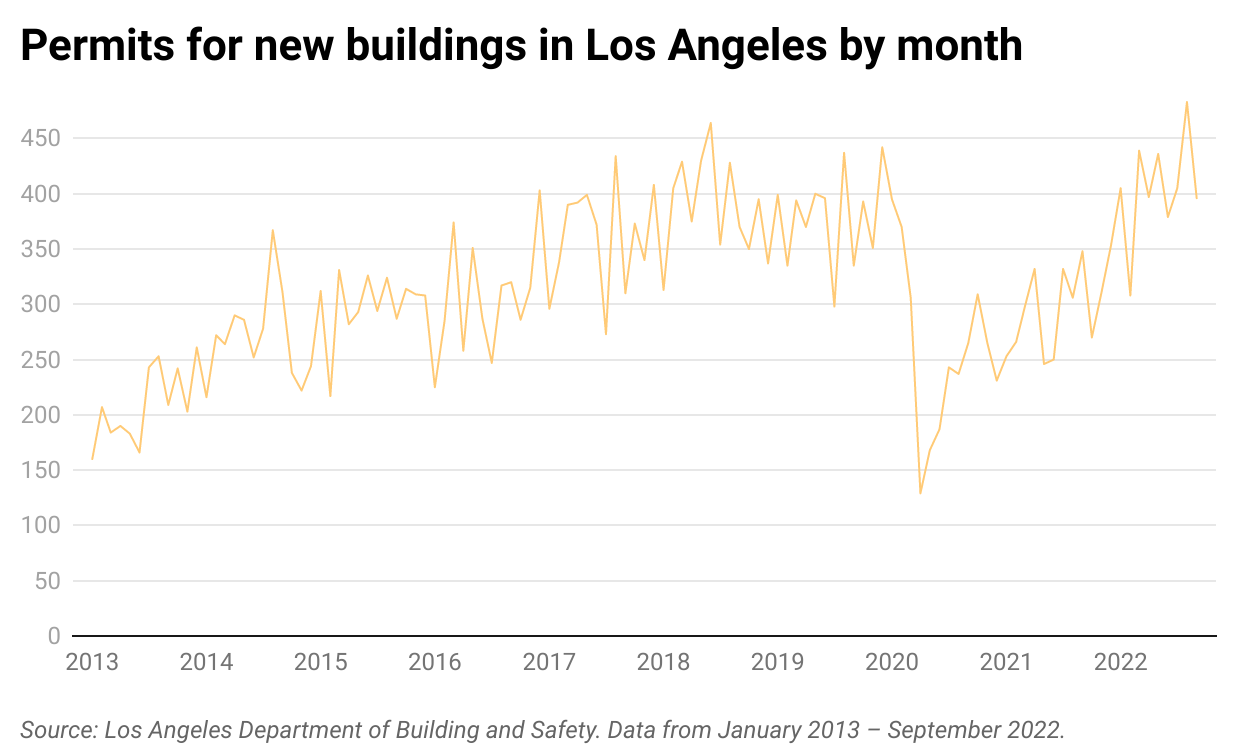

Prior to the pandemic, Los Angeles had been riding a construction boom, which included everything from skyscrapers in Downtown to apartment blocks in Sherman Oaks. But when COVID-19 hit in March 2020, the number of permits fell sharply. That April only 2,150 were issued, the lowest amount of any month on record.

Since then, the city has been making a slow but steady climb back to pre-pandemic levels. In the most recent quarter, which concluded at the end of September, Los Angeles issued 46,668 permits, according to publicly available data. That was the highest count since the 49,319 issued in the third quarter of 2019.

The city requires a permit for any type of substantial building work. This covers everything from rewiring an electrical system to creating an addition or breaking ground on a new home. A permit does not guarantee a project is actually completed, and a new building permit does not automatically correspond with an equivalent number of units created. A single permit could cover an apartment complex with hundreds of residences.

Labor and materials

The region’s construction sector is still facing headwinds, such as fluctuating lumber costs and, in some cases, a shortage of labor. In addition, rising interest rates make it more expensive to finance new projects. But the strong numbers also mean that the region could be sidestepping a recession, at least for the time being.

William Yu, an expert on the California economy at the UCLA Anderson Forecast, said construction workers have had no trouble finding work.

“What we are seeing right now is the opposite,” he said, noting that a tight labor supply might be holding the market back from growing even faster. “I don’t think we’re in a recession, but that doesn’t mean in the future, we’re not going to see one.”

Yu also holds out hope that the solid pace of building could lead to greater housing supply.

“A major problem of the California economy for the working class or middle class is the cost of housing or rent is just so high,” said Yu. “We could use softer housing costs.”

Indeed, perhaps the most encouraging sign is the number of permits for new buildings—the type most likely to lead to more housing. August produced 483 permits, the most in any month in at least a decade. During the third quarter of 2022, there were 1,284 new permits dispensed, a 37% increase from the 934 permits issued during the same period last year.

The number of new accessory dwelling units, or ADUs (such as converting a garage to a studio apartment), has also been growing.

For project Manager Andy Wickman of Goldenline Construction, Inc., the struggle has been to keep up with all the work coming in. His company is finding it hard to meet labor demands, he said, and its order book is getting longer.

“We do subcontract our work, so we’ve had some experience with our contractors being very booked out,” said Wickman. “It has been a little bit more difficult to schedule as far as getting work finished.”

He added that persistent supply-chain shortages for materials such as lumber are acting as a drag on the sector.

The labor shortage is part of a longstanding problem impacting many California industries due to a rise in the number of young professionals and retirees abandoning the state for cheaper options, said Yu. The nearly 35,000 COVID-19 deaths in Los Angeles County alone has also contributed to the situation, he added.

“We have seen out-migration with Californians moving out of California over the past two or three years,” Yu added. “Over the past two or three years, we’ve seen people retire, and they just never come back to the labor force.”

How we did it: We examined publicly available data from the city’s Department of Building and Safety from Jan. 1, 2013–Sept. 30, 2022.

Have questions or want to know more about our data? Write to us at askus@xtown.la.